What To Do If Social Security Card Is Stolen

If your Social Security card is stolen, it can lead to identity theft. To protect yourself, avoid carrying your card in your wallet and store it in a safe place. For insurance or Medicaid cards using your Social Security number, consider masking the last digits for added security. If your card is lost or stolen, immediately contact the three credit bureaus and file a police report. Follow these tips to safeguard your Social Security number and understand what to do if your card is ever compromised.

Read MoreWhat Is Digital Currency - How Does It Work

Digital currency refers to money stored and transferred in digital form, making online transactions more secure and anonymous. It works by reducing the risk of identity theft, as transactions are difficult to trace. There are various types of digital currencies, including Digital Gold Currency, Centralized Currency Systems like PayPal, and Decentralized Systems such as Bitcoin. These currencies help protect personal information during online purchases and are evolving with the growth of the internet. Learn how digital currency works and its different types in the world of e-commerce.

Read MoreWays To Save For Your Vacation In A Depressed Economy

Saving for a vacation in a depressed economy can be challenging, but there are effective strategies to help make it possible. Consider setting up automatic transfers to a vacation fund, paying off credit card debt, using any raises to boost your savings, and utilizing payroll deductions to receive a larger tax refund. By incorporating these methods into your financial routine, you can gradually save for a much-needed vacation. Don't let finances stop you from getting the break you deserve. Start saving now and look forward to your getaway.

Read MoreVictim Of Identity Theft - The Good News And The Bad News

Being a victim of identity theft can be overwhelming, but there’s good news and bad news. The process of clearing your name has improved over time, though it still involves a lot of effort. To resolve identity theft issues, act quickly, keep detailed records, contact credit bureaus, and notify your bank and credit card companies. Filing a police report is crucial too. While it can be a hassle, with the right steps, you can recover from identity theft. Learn how to protect yourself and what to do if you ever fall victim to fraud.

Read MoreTaxes And Borrowing Money - Might Go Hand In Hand

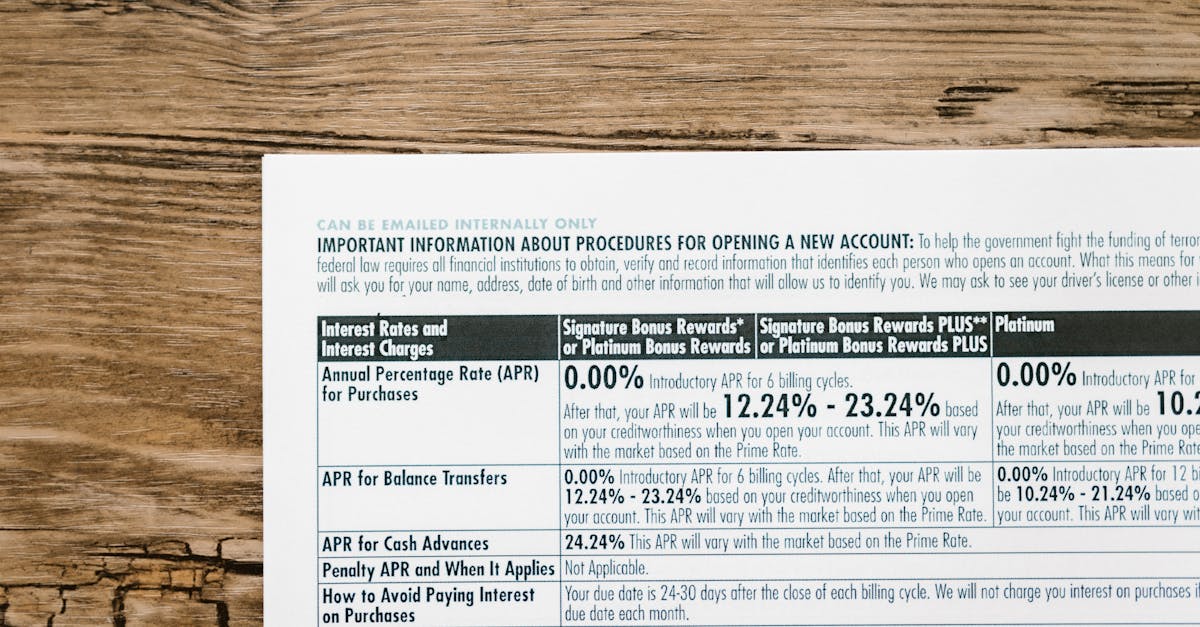

While borrowing money from your tax return may seem like an easy solution to financial struggles, it comes with significant downsides. The fees and high APR can quickly eat away at the refund, leaving you with little to show for it. Additionally, the IRS can withhold your refund, further complicating repayment. Instead of borrowing from your tax return, consider investing your money for future growth or saving throughout the year to avoid such financial pitfalls. Explore the reasons why taxes and borrowing money don’t mix and discover better alternatives to manage your money.

Read MoreSocial Security Number Background Check

A Social Security number background check provides in-depth personal information, including driving, criminal, education, and employment records. With the person's permission, you can access various details like bankruptcy, aliases, property ownership, and even military records. Services like E-Verify help validate the data. However, be aware of privacy laws, such as HIPAA, and discrimination regulations. Background checks are valuable for verifying applicants, but information older than seven years cannot impact hiring decisions. Ensure you follow legal guidelines when conducting these checks to avoid infringement on civil rights.

Read MoreSecurity For Digital Currency - Measures Are Extensive

Digital currency security measures are extensive, offering protection for your assets. With encryption, password protection, and anti-keylogger features, your money is safe from hackers. Additionally, accounts backed by gold offer inflation and recession protection, ensuring the stability of your funds. Setting up an account is free, and the fees are minimal compared to traditional banking. This secure, decentralized system allows individuals to make transactions without government oversight, making it ideal for both personal and business use.

Read MoreEmployee Criminal Background Check

Employee criminal background checks are an essential part of the hiring process to ensure a safe and secure workplace. By obtaining permission from applicants and checking their criminal history, employers can protect their business and employees from potential risks. These checks are especially important for jobs involving children, the elderly, or sensitive government positions. While waiting for background check results may delay hiring, it can prevent future issues such as theft or embezzlement. Learn the importance of conducting employee criminal background checks for maintaining business security and compliance.

Read MoreDigital Currenceny - Will Catch On In The United States

Digital currency is slowly gaining traction globally, but will it catch on in the United States? Reloadable cards, like those from Visa and Mastercard, offer a new way to pay for goods and services. These digital cards, which function like debit cards, could potentially replace credit cards and cash. Learn about the benefits of digital currency, how it could disrupt the credit card industry, and how it might be used for various purchases such as transportation and vending machines.

Read MoreCredit Union Is It Right For You

Credit unions and banks offer similar services, but which is right for you? Discover the pros and cons of credit unions, including lower fees, better savings, and potential ATM charges. Learn how credit unions, as non-profit organizations, may offer better rates, but also consider the stricter membership requirements and lack of FDIC insurance. Make an informed decision based on your needs.

Read MoreCredit Card Fees - Lead To Staggering Amounts Of Debt

Credit card debt and the associated credit card fees can lead to overwhelming financial strain. Discover how to reduce debt by cutting unnecessary expenses and using a snowball method to pay off smaller debts first. Learn practical steps to break free from the cycle of high fees, stress, and mounting debt, and regain control of your finances.

Read MoreBorrowing Money From Your 401K - Only In Emergency's

Borrowing money from your 401K should only be considered in emergencies. Understand the benefits, risks, and requirements of taking a 401K loan. Learn about repayment plans, interest rates, restrictions, and additional fees to make an informed decision. Always review your specific plan's terms before borrowing money from your retirement savings.

Read MoreBorrowing Money From Family - Think Twice

Borrowing money from family can be a sensitive matter. Learn key tips to handle such situations wisely, including assessing risks, avoiding co-signing, and giving money as gifts. Understand the challenges and precautions to take when lending or borrowing within your family to maintain financial stability and relationships.

Read MoreBorrowing Money From Cash In Advance Business

Explore the pros and cons of borrowing money from your 401k plan. Learn about loan limits, repayment terms, interest rates, and potential risks. Understand the eligibility requirements, restrictions, and fees involved in taking a loan from your retirement savings to handle unexpected financial needs.

Read MoreBorrow Money From A Credit Union

Discover the benefits of borrowing money from a credit union. Learn how credit unions offer superior service, lower fees, and rates compared to traditional banks. Understand the eligibility criteria, non-profit advantages, and insured safety of credit unions, making them a better financial option for those looking to save and borrow wisely.

Read MoreThe Value Of A Brand

Brand value plays a critical role in a company's financial worth and stock price, yet its true worth is subjective. This post explores how brand value is assessed, using Coca Cola as an example to estimate brand worth based on price differences and sales. While brand value can impact asset-based company valuations, the fair value of a stock is ultimately tied to a company’s profits, not just its brand name.

Read MoreAirline Price Wars - Capitalize On Your Air Fare

Save money on your next flight by capitalizing on airline price wars and following practical tips. Book flights in advance, be flexible with travel dates, explore upgrades and discounts, and bundle services like hotels and car rentals. These strategies help you secure the best deals on airfare, making travel more affordable for vacations or work trips.

Read MoreBank Fees One Of The Ways Banks Make Money

Learn how banks make money through fees like overdraft charges and discover practical tips to avoid them. Protect yourself by avoiding last-minute deposits, relying less on credit cards, using cash for daily expenses, and reconsidering overdraft protection. Save money and reduce financial stress with these easy-to-follow strategies.

Read MoreBenefits Of Digital Currency - People Are Aware Of

Discover the numerous benefits of digital currency, including lower transaction fees, enhanced security, faster transactions, global accessibility, privacy, and eco-friendliness. Learn how digital currency ensures financial freedom, convenience, and peer-to-peer payments while reducing environmental impact. Embrace the future of money with this revolutionary payment system.

Read MoreBigger Banks Better - Bigger Not Always Better

Explore whether bigger banks are better or not. Discover how smaller community banks can offer better customer service, competitive rates, and benefits like small business loans. Learn how supporting local banks not only helps you save but also strengthens your community and creates jobs.

Read MoreBundle All Insurance Policies - Everything Can Be Insured

Bundle all insurance policies to save money and enjoy exclusive benefits. From home and auto insurance to health and life coverage, bundling simplifies your plans and offers discounts up to 10% or more. Learn how combining services with one company can help you get the most value without sacrificing quality.

Read MoreCashless Society - Never See One Red Cent

Explore the rise of a cashless society, where digital payments, debit cards, and mobile wallets replace cash. Learn about direct deposits, electronic transactions, reloadable cash cards, and the shift to digital progress. Understand how these advancements are shaping consumer habits and redefining the future of money management.

Read MoreCredit Score Controlling Insurance Rates

Did you know your credit score can influence your insurance premiums? Insurance companies often consider credit history when determining rates, with poor credit leading to higher premiums. While some argue it's unfair, this policy has become standard. Learn how to manage your credit score to potentially reduce your insurance rates, or explore insurance companies that don’t use this practice.

Read MoreGovernment Imposed Medical Insurance - Hot Topic For All

Government-imposed medical insurance, particularly the debate around socialized healthcare, has been a hot topic for years. Countries like Canada have successfully implemented such systems, providing affordable healthcare without long wait times. While concerns about quality of care and higher taxes exist, the potential benefits of universal healthcare are significant. Implementing a fair system where taxes contribute modestly to healthcare costs could ensure that all citizens have access to necessary medical care without the financial burden. Learn about the pros and cons of government-imposed healthcare and how smart implementation can make it work.

Read MoreIdentity Stolen What To Do -Tips How To Handle The Crisis

If your identity is stolen, it's essential to act quickly to minimize the damage. This article provides practical steps to take when you suspect identity theft. Learn how to monitor your credit reports, recognize warning signs like missing credit cards or suspicious mail, and how to report the theft to credit bureaus, banks, and law enforcement. Early detection is key, so follow these tips to secure your financial future and protect your personal information.

Read More