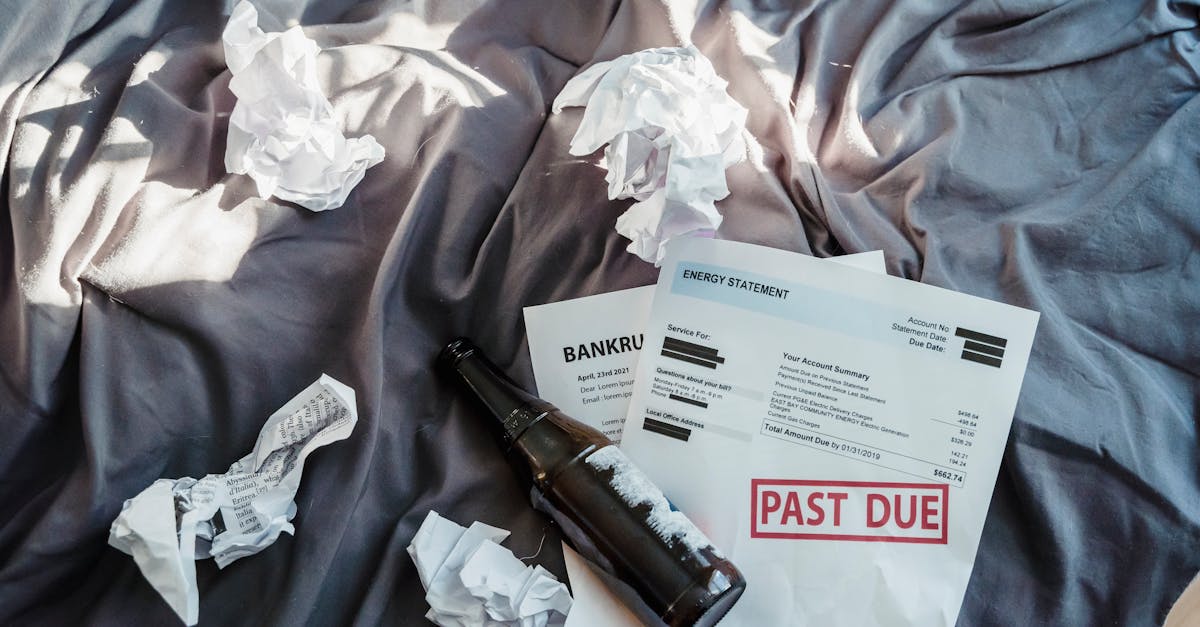

Financial Conditions Getting Tough Turn To Debt Consolidation

When financial conditions begin to get tough and you find yourself facing difficulty making your payments, you may need to turn to a debt consolidation arrangement in order to ensure that you don't drown in a sea of late payments and bad debt. Such loans are available, and you may have to decide between an unsecured debt consolidation loan and a loan that is secured by equity in a major asset you own, such as your home or a late model vehicle. Whichever you choose, you should take care to ensure that you have a complete understanding of your agreements and responsibilities.

"We're seeing more and more people looking at an unsecured debt consolidation loan as a way to help them find a solution to their financial difficulties," says business writer and financial analyst Carl Walins. "A restructuring of your debt using a loan may be a good choice, but consider the differences between an unsecured debt consolidation loan and one that is secured with something of value, such as the equity in your home. You may find that the loan parameters vary widely, even from the same lender, depending on whether or not you choose a secured or an unsecured debt consolidation loan".

Walins warns consumers to read their loan agreements carefully before signing off on a debt consolidation loan. While stress over making your monthly payments may make you eager to close your loan and to ease the burden of your debts, it is imperative that you have a complete understanding of all of the terms surrounding your secured or unsecured debt consolidation loan. There may be conditions that affect your interest rate or fees that could be incurred if you should not comply with the precise requirements of the agreement. For instance, you may be subject to fees for pre-payment or early payoff of your loan balance. In such cases, it would be imprudent for you to pay off your secured or unsecured debt consolidation loan early and incur a penalty that could be greater than the amount of interest accrued on a monthly basis.

"Whenever you enter into a financial agreement you should always take care to read and understand the details of your contract before you sign it," Walins reminds us. "If you have access to a financial advisor or an attorney, you may want to ask them to review the documents before you sign in order to make sure there are no hidden 'gotchas' that could come back to haunt you later".

Whether you choose a secured or unsecured debt consolidation loan as a vehicle to help you reduce your monthly financial burden, you should take great care to make certain you have a complete understanding of the terms of your loan before you sign the documents.

Keywords: Debt Consolidation Loan, Financial Conditions, Unsecured Debt Consolidation Loan, Secured Loan, Monthly Payments, Financial Burden, Interest Rate, Debt Restructuring, Loan Agreement, Financial Advisor

Powered by Froala Editor